INFORMATION

the Securities Exchange Act

(Name of Registrant as Specified | ||||

| (Name of Person(s) Filing Proxy Statement if other than the Registrant) | ||||

10, 2023 meeting by visiting www.virtualshareholdermeeting.com/ASB2023. Banc-Corp and hope you will be able to join us at the Annual Meeting. MEETING VIRTUALLY. NOMINEES FOR ELECTION TO OUR BOARD DIRECTOR QUALIFICATIONS AFFIRMATIVE DETERMINATIONS REGARDING DIRECTOR INDEPENDENCE INFORMATION ABOUT THE BOARD OF DIRECTORS BOARD COMMITTEES AND MEETING ATTENDANCE SEPARATION OF BOARD CHAIRMAN AND CEO DIRECTOR NOMINEE RECOMMENDATIONS COMMUNICATIONS BETWEEN SHAREHOLDERS, INTERESTED PARTIES AND THE BOARD COMPENSATION AND BENEFITS COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION STOCK OWNERSHIP SECURITY OWNERSHIP OF BENEFICIAL OWNERS STOCK OWNERSHIP GUIDELINES FOR EXECUTIVE OFFICERS AND DIRECTORS SECURITY OWNERSHIP OF DIRECTORS AND MANAGEMENT COMMON STOCK RESTRICTED STOCK UNITS DEPOSITARY SHARES OF PREFERRED STOCK OWNERSHIP IN PROPOSAL 2: ADVISORY APPROVAL OF ASSOCIATED RECOMMENDATION OF THE BOARD OF DIRECTORS COMPENSATION AND BENEFITS COMMITTEE REPORT DIRECTOR COMPENSATION IN RELATED PARTY TRANSACTIONS RELATED PARTY TRANSACTION POLICIES AND PROCEDURES PROPOSAL FEES PAID TO INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM RECOMMENDATION OF THE BOARD OF DIRECTORS REPORT OF THE AUDIT COMMITTEE OTHER MATTERS THAT MAY COME BEFORE THE MEETING SHAREHOLDER PROPOSALS telephone or personal interview. Associated has retained to receive a paper or e-mail copy of these materials, you must make the request over the Internet at www.proxyvote.com, by calling toll free 1-800-579-1639, or by sending an e-mail to sendmaterial@proxyvote.com. There is no charge to you for requesting a paper or e-mail copy par value $0.01 meeting consist of shares of its Common Stock, of which her resignation following certification of the shareholder vote. The Corporate Governance and Social Responsibility 2023. imprinted on your Notice or proxy card in order to vote online. The Internet voting procedures are designed to authenticate The Corporate Secretary of Associated is Randall J. Erickson, 433 Main Street, Green Bay, Wisconsin 54301. He will not stand for re-election to the Badger Meter Inc. board in April 2023. Mr. Omnitracs in 2014, and a director of CNS, a publicly traded consumer goods company, from 2003 until its 2006 sale to GlaxoSmithKline. Corporate Development Committee. Mr. The Audit Committee is also responsible for overseeing certain aspects of Associated’s environmental, social and governance (known as “ESG”) program, including the ESG-related aspects of audit and audit risk oversight. the structure and amount of compensation of 24. Compensation and Benefits Committee duties also include overseeing certain aspects of Associated’s ESG program, including reviewing and evaluating policies and programs, and taking action as necessary, with respect to human capital management, diversity, equity and inclusion, and workforce practices and policies. The Corporate Governance and Social Responsibility Committee is also responsible for overseeing aspects of Associated’s ESG program related to corporate governance, shareholder rights, board and committee structure, ESG framework, and ESG disclosures. The Enterprise Risk Committee, through its oversight of the lending policy and risk assessment, is also responsible for reviewing and approving certain components of the ESG program, which may include risk assessment, lending policy, data privacy and security, fair lending, and community development and CRA-related programs, climate change and carbon emissions, natural resources, environmental risk management, environmental and social lending policies, charitable giving and consumer practices. for the past five years) of each proposed nominee; (2) the number of shares of Associated beneficially owned (as defined by Section 13(d) of the Securities Exchange applicable, on a regular basis employee is a member of the Compensation and Benefits Committee. owner of 5% or more of our outstanding Common Stock on Name and Address Stock based on its daily closing price. These Beneficial Owner John F. Bergstrom Michael T. Crowley, Jr. R. Jay Gerken Judith P. Greffin William R. Hutchinson Robert A. Jeffe Eileen A. Kamerick Gale E. Klappa Richard T. Lommen Cory L. Nettles Karen T. van Lith John (Jay) B. Williams All Directors as a group ” leadership abilities result in overall success for Associated and increased value to our shareholders. Associated competes with a large number of financial institutions across the country for the services of qualified While the peer group the compensation consultant advised that the additional comparisons, beyond the peer group, provided a broader perspective from which to appropriately compare Composition of Total Compensation Short-term incentive targets are established as a percent of base salary, consistent with market practice. The Base Salary The Committee approved LONG-TERM INCENTIVE COMPENSATION Plan. which creates alignment between executive pay and shareholder value and promotes executive retention. The RSUs granted in The Performance Period Completed Risk Assessment the Committee determined that Deferred Compensation Plan focusing on the long-term goal of increasing capital gains. All NEOs were eligible to elect to defer receipt of shares in 2022 and income stream in the form of an annuity at retirement. A colleague becomes eligible to participate retirement. Supplemental Executive Retirement Plans Change of Control The Committee, Name and Principal Position Philip B. Flynn President and CEO Christopher J. Del Moral-Niles Executive Vice President, Chief Financial Officer Randall J. Erickson Executive Vice President, General Counsel, Corporate Secretary and Chief Risk Officer(6) John A. Utz Executive Vice President, Head of Corporate Banking and Milwaukee Market President David L. Stein Executive Vice President, Head of Consumer & Business Banking Name Philip B. Flynn Christopher J. Del Moral-Niles Randall J. Erickson John A. Utz David L. Stein Name Philip B. Flynn Christopher J. Del Moral-Niles Randall J. Erickson John A. Utz David L. Stein Further information regarding the RAP can be found in the 37. termination and the monthly premiums in respect of the life insurance in effect for the executive on the date of termination; benefits. determining vesting) held by the NEOs would vest upon such an event. Assuming one of the events in the prior two sentences (each a NEOs.” The material terms of the non-employee director compensation arrangements Directors may Name John F. Bergstrom R. Jay Gerken Judith P. Greffin(1) William R. Hutchinson Robert A. Jeffe Eileen A. Kamerick Gale E. Klappa Richard T. Lommen Cory L. Nettles Karen T. van Lith John (Jay) B. Williams Under Section 16(a) of the Exchange Act, directors and executive officers that no other reports were required, Certain officers and directors of Associated and its subsidiaries, members of their families, and the companies or firms with which they are affiliated were customers of, and had banking transactions with, We have adopted written Related Party Transaction Policies and Procedures regarding the identification, review and approval or ratification of transactions are not covered by this policy, including: transactions involving compensation for services provided to Associated as a director or executive officer, ordinary course banking transactions, and transactions where all receive proportional benefits, such as dividends. A related party is any executive officer, director, nominee for election as director or a greater-than-5% shareholder of Associated, and any Under the policies and procedures, the Corporate Governance and Social Responsibility Committee reviews and either approves or disapproves any interested transactions. In considering interested transactions, the Corporate Governance and Social Responsibility Committee takes into account, among other factors it deems appropriate, whether the interested transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances and the extent of the related Audit Fees(1) Audit-Related Fees(2) Tax Fees All Other Fees Total Fees shareholders. TableContents

2018Filing Fee (Check all boxes that apply):

24, 201825, 2023

13, 201824, 2018, at25, 2023, which will be conducted solely online via a live webcast. You will be able to attend the KI Convention Center, 333 Main Street, Green Bay, Wisconsin. We will present an economic/investment update beginning at 10:00 a.m., with Associated's investment professionals providing an update onAnnual Meeting of Shareholders of Associated Banc-Corp online, vote your shares electronically, and submit questions prior to and during the equity market and interest rate environment.13, 2018,10, 2023, we began mailing a Notice of Internet Availability of Proxy Materials (Notice) to our shareholders informing them that our Proxy Statement, the 20172022 Summary Annual Report to Shareholders and our 20172022 Form 10-K,10‑K, along with voting instructions, are available online. As more fully described in the Notice, shareholders may choose to access our proxy materials on the Internet or may request paper copies. This allows us to conserve natural resources and reduces the cost of printing and distributing the proxy materials, while providing our shareholders with access to the proxy materials in a fast, easily accessible and efficient manner.Your Board of Directors and management look forward to personally greeting those shareholders who are able to attend. always appreciate your input and interest in Associated Banc-Corp.![]()

William R. Hutchinson

Philip B. Flynn

24, 2018

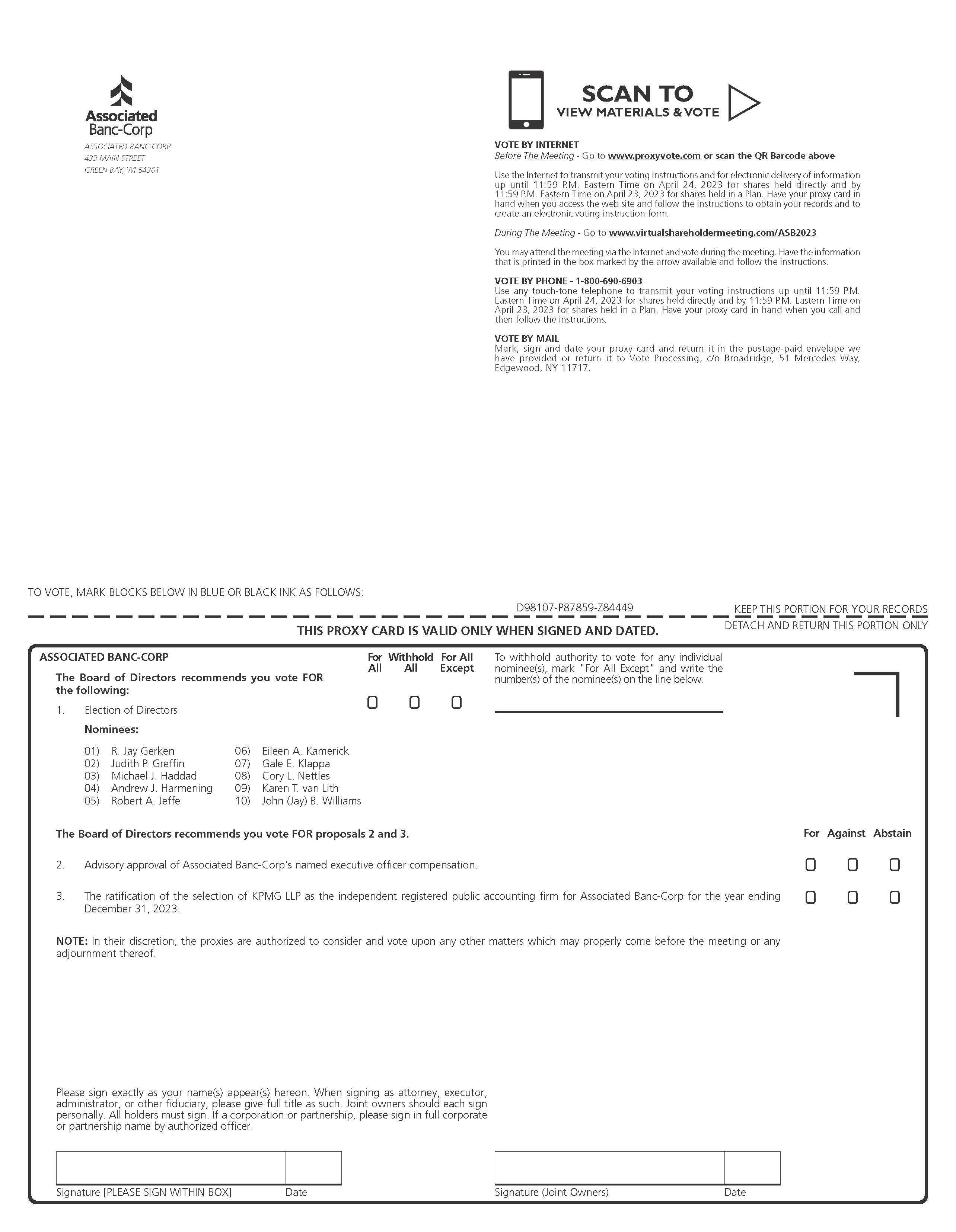

25, 20231310 individuals recommended by the Board of Directors to serve as directors.Banc-Corp'sBanc-Corp’s named executive officer compensation.Advisory vote on the frequency of advisory approval of Associated Banc-Corp's named executive officer compensation.4.Banc-CorpBanc- Corp for the year ending December 31, 2018.5.24, 2018:The25, 2023:the 20172022 Summary Annual Report to Shareholders and the 20172022 Form 10-K10-K are available online at http://materials.proxyvote.com/045487.CANARE ENCOURAGED TO USE ONE OF THE FOLLOWING METHODS TO VOTE IN ADVANCE OF THE ANNUAL MEETING OF SHAREHOLDERS, NO LATER THAN 11:59 P.M. ET ON APRIL 24, 2023:YOU CAN ALSO VOTE USING THE INTERNET OR THE TELEPHONE, YOU ARE URGED TO SIGN, DATE, AND PROMPTLY RETURN YOUR PROXY SO THAT YOUR SHARES MAY BE VOTED IN ACCORDANCE WITH YOUR WISHES AND IN ORDER THATTO HELP ENSURE THE PRESENCE OF A QUORUM AT THE MEETING MAY BE ASSURED.MEETING. REGARDLESS OF THE NUMBER OF SHARES YOU HOLD, THE PROMPT RETURN OF YOUR SIGNED PROXY OR YOUR PROMPT VOTE BY USING THE INTERNET OR THE TELEPHONE REGARDLESS OF THE NUMBER OF SHARES YOU HOLD, WILL AID ASSOCIATED BANC-CORP INBY REDUCING THE EXPENSE OF ADDITIONAL PROXY SOLICITATION. THE GIVING OF YOUR PROXY DOES NOT AFFECT YOUR RIGHT TO VOTE IN PERSON IF YOU ATTEND THE MEETING.

13, 201810, 2023GENERAL INFORMATION1GENERAL INFORMATION PROPOSAL 1: ELECTION OF DIRECTORS BOARD DIVERSITY DIRECTOR SKILLS AND EXPERIENCE MATRIX RECOMMENDATION OF THE BOARD OF DIRECTORS BOARD DIVERSITY13DIRECTORS'DIRECTORS’ DEFERRED COMPENSATION PLANBANC-CORP'SBANC-CORP’S NAMED EXECUTIVE OFFICER COMPENSATION2022 ENVIRONMENTAL, SOCIAL & GOVERNANCE HIGHLIGHTS LETTER TO SHAREHOLDERS COMPENSATION DISCUSSION AND ANALYSIS DIRECTOREXECUTIVE COMPENSATION4440DIRECTOR COMPENSATION DIRECTORS'DIRECTORS’ DEFERRED COMPENSATION PLAN 2017PROPOSAL 3: ADVISORY VOTE ON FREQUENCY OF ADVISORY APPROVAL OF ASSOCIATED BANC-CORP'S NAMED EXECUTIVE OFFICER COMPENSATIONRECOMMENDATION OF THE BOARD OF DIRECTORS46SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE474:3: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRMPURPOSE "Board"“Board”) of Associated Banc-Corp ("Associated"(“Associated”) to be voted at the Annual Meeting of Shareholders at 11:00 a.m. (CDT) on Tuesday, April 24, 2018,25, 2023, (the "Annual Meeting"“Annual Meeting”), which will be held virtually at the KI Convention Center, 333 Main Street, Green Bay, Wisconsin,www.virtualshareholdermeeting.com/ASB2023, and at any and all adjournments of the Annual Meeting.Associated'sAssociated’s directors, officers, and employeescolleagues may, withoutD.F. King & Co., Inc.Innisfree M&A Incorporated to solicit proxies for the Annual Meeting from brokers, bank nominees and other institutional holders. Associated has agreed to pay D.F. King & Co., Inc. up to $9,000 plus its out-of-pocket expensesInnisfree M&A Incorporated $25,000 for theseproxy solicitation services. Arrangements will be made with brokerage houses, custodians, nominees, and other fiduciaries to send proxy materials to their principals, and they will be reimbursed by Associated for postage and clerical expenses.INTERNET AVAILABILITY OF PROXY MATERIALS ("SEC"(“SEC”) rules allow us to make our Proxy Statement and other annual meeting materials available to you on the Internet. On or about March 13, 2018,10, 2023, we began mailing a Notice of Internet Availability of Proxy Materials (the "Notice"“Notice”), to our shareholders advising them that this Proxy Statement, the 20172022 Summary Annual Report to Shareholders and our 2017 Annual Report on Form 10-K for the year ended December 31, 2022 (the "2017“2022 Form 10-K"10-K”), along with voting instructions, may be accessed over the Internet at http://materials.proxyvote.com/045487. You may then access these materials and vote your shares over the Internet, or request that a printed copy of the proxy materials be sent to you. Iftofrom sendmaterial@proxyvote.com. If you would like to receive a paper or e-mail copy of the proxy materials, please make your request on or before April 10, 2018,11, 2023, in order to facilitate timely delivery. If you previously elected to receive our proxy materials electronically, these materials will continue to be sent via e-mail unless you change your election.WHO CAN VOTE February 27, 2018,March 1, 2023, as the record date (the "Record Date"“Record Date”) for the determination of shareholders entitled to receive notice of, and to vote at, the Annual Meeting. Each share of Associated'sAssociated’s common stock,("Common Stock"(the “Common Stock”), is entitled toQUORUM AND SHARES OUTSTANDING 170,199,951150,868,335 shares were issued and outstanding at the close of business on the Record Date.REQUIRED VOTES –- Election of Directors1310 nominees receivingwho receive the largest number of affirmative votes cast at the Annual Meeting will be elected as directors. Under Associated'sAssociated’s Corporate Governance Guidelines, any nominee in an uncontested election who receives a greater number of votes "withheld"“withheld” from than votes “FOR” his or her election than votes "FOR" such election is required to tender his orABSTENTIONS AND BROKER NON-VOTES HOW YOU CAN VOTE "FOR"“FOR” the election of the Board'sBoard’s nominees for director, "FOR"“FOR” the advisory approval of Associated'sAssociated’s named executive officer ("NEO"(“NEO”) compensation "ONE YEAR" for the advisory vote on the frequency of advisory approval of Associated Banc-Corp's NEO compensation and "FOR"“FOR” the ratification of the selection of KPMG LLP as Associated'sAssociated’s independent registered public accounting firm for 2018.–- www.proxyvote.com. Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time on April 23, 2018.24, 2023. Have your Notice or proxy card, if you have requested paper copies of the proxy materials, in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction form. You will be required to enter the unique control numbershareholders'shareholders’ identities, to allow shareholders to provide their voting instructions, and toshareholders'shareholders’ instructions have been recorded properly. You should be aware that there might be costs associated with your electronic access, such as usage charges from Internet access providers and telephone companies.If you vote by Internet, please do not mail your proxy card.–- 1-800-690-6903. Use any touch-tone telephone to transmit your voting instructions up untilno later than 11:59 p.m. Eastern Time on April 23, 2018.24, 2023. Have your Notice or proxy card, if you have requested paper copies of the proxy materials, in hand when you call and then follow the instructions.If you vote by telephone, please do not mail your proxy card.IN PERSON –also vote in person atonline during the Annual Meeting by following the instructions provided on the meeting website during the Annual Meeting. For additional information, see the section below entitled “Virtual Meeting Information.”REVOCATION OF PROXY date.date, or by voting at the Annual Meeting via the meeting platform. Proxies may not be revoked byor by telephone.prior to the Annual Meeting.VIRTUAL MEETING INFORMATION TableContents

conduct during the Annual Meeting. You will also be able to examine our shareholder list during the Annual Meeting by following the instructions provided on the meeting website.Directorstermsterm expiring at the 20192024 Annual Meeting and with respect to each director, until his or her successor is duly elected and qualified. The term of each current director listed under "Nominees“Nominees for Election to Our Board"Board” expires at the Annual Meeting."FOR"“FOR” the election of each of the individuals nominated to serve as directors. The biographical information below for each nominee includes the specific experience, qualifications, attributes or skills that led to the Corporate Governance Committee'sand Social Responsibility Committee’s conclusion that such nominee should serve as a director. The 1310 nominees receiving the largest number of affirmative votes cast at the Annual Meeting will be elected as directors. Under Associated'sAssociated’s Corporate Governance Guidelines, any nominee in an uncontested election who receives a greater number of votes "withheld"“withheld” from than votes “FOR” his or her election than votes "FOR" such election is required to tender his or her resignation following certification of the shareholder vote. The Corporate Governance and Social Responsibility Committee is required to make a recommendation to the Board with respect to any such letter of resignation, and the Board is required to take action with respect to this recommendation and to disclose its decision and decision-making process. Correspondence may be directed to nominees at Associated's executive offices.On February 1, 2018, Associated completed its acquisition of Bank Mutual Corporation ("Bank Mutual"). Pursuant to Agreement and Plan of Merger dated as of July 20, 2017, by and among Associated and Bank Mutual (the "Agreement"), Bank Mutual merged with and into Associated, with Associated as the surviving corporation (the "Merger"). At the effective time of the Merger, and in accordance with the terms of the Agreement, Associated increased the size of its Board, and Mr. Michael T. Crowley, Jr., former chairman and chief executive officer of Bank Mutual, was appointed to the Board. Mr. Crowley is nominated by the Board to stand for election at the Annual Meeting.The information presented below is as of February 27, 2018.NOMINEES FOR ELECTION TO OUR BOARDPhilip B. Flynn

Director since 2009Age: 60Mr. Flynn joined Associated Banc-Corp as President and Chief Executive Officer in December 2009. Mr. Flynn has more than 30 years of financial services industry experience. Prior to joining Associated, Mr. Flynn held the position of Vice Chairman and Chief Operating Officer of Union Bank in California. During his nearly 30-year career at Union Bank, he held a broad range of other executive positions, including chief credit officer and head of commercial banking, specialized lending and wholesale banking activities. Mr. Flynn serves as a director or trustee of the Financial Services Roundtable, the Medical College of Wisconsin, the Milwaukee Art Museum, St. Norbert College, Wisconsin Manufacturers & Commerce, and the Green Bay Packers, Inc.Mr. Flynn's qualifications to serve as a director and Chair of the Corporate Development Committee include his extensive experience in the banking industry and his significant executive management experience at a large financial institution.John F. Bergstrom

Director since 2010Age: 71Mr. Bergstrom is Chairman and Chief Executive Officer of Bergstrom Corporation of Neenah, Wisconsin, one of the top 50 largest automobile dealer groups in the United States. Mr. Bergstrom also serves as a director of Kimberly-Clark Corporation (NYSE: KMB), WEC Energy Group (NYSE: WEC), Advance Auto Parts (NYSE: AAP), and is a director emeritus of Green Bay Packers, Inc.Mr. Bergstrom's qualifications to serve as a director of Associated and member of the Compensation and Benefits Committee and the Corporate Governance Committee include his more than 30 years of leadership experience as a chief executive officer and over 50 years of combined experience as a director of various public companies. Mr. Bergstrom provides the board with a deep understanding of consumer sales and of Wisconsin's business environment. Mr. Bergstrom has completed the National Association of Corporate Directors ("NACD") corporate training program for Compensation Committee members and is now designated as a Master Fellow for Compensation Committee, governance and best practices. He was also designated as one of the top 100 corporate directors in America for 2017 by NACD Directorship magazine.Michael T. Crowley, Jr.R. Jay Gerken

Director since 2018Age: 75Mr. Crowley previously held the position of Chairman for Bank Mutual Corporation from 2000 to 2018, serving as CEO for the bank from 2000 to 2013, and President from 2000 to 2010. Mr. Crowley's extensive experience in the financial community includes serving as Chairman for the Federal Home Loan Bank System Stockholder Study Committee, the State of Wisconsin Savings Bank Review Board, and the State of Wisconsin Savings and Loan Review Board. He also served as Vice Chairman for Federal Home Loan Bank of Chicago, and a director of The Wisconsin Partnership for Housing Development, Inc.Mr. Crowley's qualifications to serve as a director of Associated include his extensive executive management experience at a large financial institution, his significant experience in the banking industry, as well as his leadership experience as Chairman of Bank Mutual Corporation.

R. Jay Gerken

Director since 201466711817 mutual funds with approximately $35$30 billion in assets associated with Sanford C. Bernstein Fund, Inc. and, the Bernstein Fund, Inc. and the AB Multi-Manager Alternative Fund, which are mutual fund complexes. Mr. Gerken served as the President and Chief Executive Officer of Legg Mason Partners Fund Advisor, LLC from 2005 until June 2013. During that period, he was also the President and a director of the Legg Mason and Western Asset mutual fundfunds complexes with combined assets in excess of $100 billion. Previously, Mr. Gerken served in a similar capacity at Citigroup Asset Management Mutual Funds from 2002 to 2005.Gerken'sGerken’s qualifications to serve as a director of Associated, Chairmanmember of the Audit Committee and member of the Enterprise Risk Committee include his extensive investment and financial experience, as well as his executive leadership roles at several large mutual funds. Mr. Gerken is certified as a National Association of Corporate Directors (“NACD”) Board Leadership Fellow. As a Chartered Financial Analyst with experience as a portfolio manager and in overseeing the preparation of financial statements, Mr. Gerken also meets the requirements of an audit committee financial expert.Judith P. Greffin

Judith P. Greffin

5762nation'snation’s largest publicly held personal lines insurer, from 2008 to 2016.2008-2016. Prior to this position, Ms. Greffin held several other key positions at Allstate from 1990-2008. Ms. Greffin currently serves on the board of Church Mutual Insurance Company and Trustmark Mutual Holding Company. In addition, she serves on the boards of the Northwestern Memorial Foundation,Medical Group, where she chairs the investment committee, and serves as a member of the audit committee of Northwestern Memorial Healthcare, the investment committee of the Field Museum of Natural History, where she chairs the finance committee, and DePaul University, where she serves as the chair of the investment committee. She serves as chair of the board of Growing Community Media, a publisher of local community journalism. She is also a member of the Miami University Ohio Business Advisory CouncilFoundation board of trustees where she serves as the chair of the investment committee and the Economic Club of Chicago.Greffin'sGreffin’s qualifications to serve as a director of Associated and member of the Enterprise Risk Committee and the Trust Committee include her extensive investment, strategy and risk mitigation background as well as her executive leadership experience at a large publicly traded company. Ms. Greffin is also a Chartered Financial Analyst.William R. Hutchinson

Michael J. Haddad

1994

20197556HutchinsonHaddad is Chairman of the Board. He has served as President of W. R. Hutchinson & Associates, Inc., an energy industry consulting company, since April 2001. Previously, he was Group Vice President, Mergers & Acquisitions, of BP Amoco p.l.c. from January 1999 to April 2001 and held the positions of Vice President – Financial Operations, Treasurer, Controller, and Vice President – Mergers, Acquisitions & Negotiations of Amoco Corporation, Chicago, Illinois, from 1981 until 1999. Mr. Hutchinson also serves as an independent director and Chairman of the Audit Committees of approximately 27 closed-end mutual funds in the Legg Mason mutual fund complex.Mr. Hutchinson's qualifications to serve as ChairmanChair of the Board of Directors of Schreiber Foods, Inc., an employee-owned, international dairy company headquartered in Green Bay, Wisconsin, since October 1, 2019. He served as President and Chief Executive Officer of Schreiber Foods, Inc. from 2009 to 2019, having served in a number of positions of increasing responsibility with the company since 1995. Mr. Haddad is also a member of the Board of Directors of Bellin Health Systems, the Board of Directors of the Green Bay Packers, Inc. and the Board of Directors of the Innovation Center for US Dairy and the Board of Directors of the John and Ingrid Meng Family Foundation.Corporate DevelopmentAudit Committee and of the Trust Committee include executive level responsibility for the financial operationshis extensive experience as a CEO and board member of a large publicly tradedglobal food company with annual revenues over $5 billion, and significant mergershis long-standing familiarity with the markets in which Associated is headquartered and acquisitions experience. Althoughserves. Mr. Hutchinson is not currently serving on Associated's Audit Committee, heHaddad also meets the requirements of an audit committee financial expert.Robert A. Jeffe

Andrew J. Harmening

Robert A. Jeffe

6772Capital'sCapital’s board of directors. Effective October 2017, Mr. Jeffe was elected as a Director of OAG Analytics, Inc., which has a web based software platform that provides, through machine learning, optimization advice for drilling and field development for energy exploration and production companies.directors from January 2002 to June 2004. Mr. Jeffe has more than 34 years of investment banking experience and prior to working at Deutsche Bank;Bank, he was with Morgan Stanley, Credit Suisse and Smith Barney (now Citigroup) serving at all three firms as Managing Director, Head of the Global Energy and Natural Resources Group, and a member of the Investment Banking Management Committee and Global Leadership Group. At Morgan Stanley, Mr. Jeffe also was Co-Head of Global Corporate Finance.Jeffe is also Chairman and Founder of the Central American Healthcare Initiative.Mr. Jeffe'sJeffe’s qualifications to serve as a director of Associated and memberchair of the Audit Committee and a member of the Corporate Development Committee and the Enterprise Risk Committee include his extensive investment banking and corporate finance experience, as well as his leadership roles at several large financial institutions and energy companies and his Board positions at these energy firms. Mr. Jeffe also meets the requirements of an audit committee financial expert.Eileen A. Kamerick

Eileen A. Kamerick

5964Ms. Kamerick is an adjunct professor at leading law schools and consults on corporate governance and financial strategy matters. Previously, from March 2014 until January 2015, she was Senior Advisor to the CEO and Executive Vice President and CFO of ConnectWise, Inc., an international software and services company. From October 2012 until July 2013, Ms. Kamerick was Chief Financial Officer of Press Ganey Associates, a leading health care analytics and strategic advisory firm. She previously served as the Managing Director and Chief Financial Officer of Houlihan Lokey, an international investment bank, and as Senior Vice President, Chief Financial Officer and Chief Legal Officer of Tecta America Corporation, the largest commercial roofing company in the United States. Prior to joining Tecta America Corporation, she served as Executive Vice President and Chief Financial Officer of BearingPoint, Inc., a management and technology consulting firm from May 2008 to June 2008. BearingPoint, Inc. filed for reorganization under Chapter 11 of the US Bankruptcy code on February 18, 2009. Ms. Kamerick has also served as Chief Financial Officer at several leading companies, includingHoulihan Lokey, Heidrick & Struggles International, Inc.;, Leo Burnett;Burnett, and BP Amoco Americas. She also currently serves on the board of directors of Hochschild Mining, plc (LON:HOC) and, serves as an independent director for VALIC Company I, is an independent director of approximately 2718 closed-end mutual funds in the Legg Mason mutual fund complex. She also currentlycomplex, and serves as Independent Trusteeindependent director for bothACV Auctions (NASDAQ:ACVA). She will not stand for re-election to the Hochschild Mining, plc board in May 2023. She previously was a trustee for the 24 AIG Funds and Anchor Series Trust. She previously served on the Board of Directors of Westell Technologies, Inc. (NASDAQ: WSTL). SheTrust Funds from January 2018 until December 2021. Ms. Kamerick has formal training in law, finance, and accounting.

Ms. Kamerick'sKamerick’s qualifications to serve as a director of Associated, Chair of the Corporate Governance and Social Responsibility Committee and member of the Compensation and Benefits Committee and the Corporate Development Committee include her executive level responsibilities for the financial operations of both public and private companies, her board positions on public companies, and her experience as a frequent law school lecturer on corporate governance and corporate finance. She is also a National Association of Corporate Directors Board Leadership Fellow. In addition, Ms. Kamerick has earned the National Association of Corporate Directors Directorship Certification. In addition, Ms. Kamerick has earned the CERT, Certificate in Cybersecurity Oversight. In 2022, Ms. Kamerick also attended the NACD Master Class, a course designed for experienced public company board and board committee leaders. In 2022, Ms. Kamerick was recognized as an NACD Directorship 100 honoree. Although Ms. Kamerick is not currently serving on Associated'sAssociated’s Audit Committee, she meets the requirements of an audit committee financial expert.Gale E. Klappa

Gale E. Klappa

6772Mr. Klappa is the Chairman and Chief Executive OfficerChairman of WEC Energy Group (NYSE: WEC) of Milwaukee, Wisconsin, one of the nation'snation’s premier energy companies. Mr. Klappa had previously retired aswas Chairman and Chief Executive Officer of WEC Energy Group infrom October 2017 until February 2019, and served as non-executive Chairman from May 2016 and was non-executive Chairman until October 10, 2017 when the Board of Directors2017. Mr. Klappa served as Chairman and Chief Executive Officer of WEC Energy Group appointed Mr. Klappa Chief Executive Officer.from June 2015 until May 2016. Mr. Klappa had served as Chairman and Chief Executive Officer of Wisconsin Energy and We Energies from May 2004 until June 2015. Previously, Mr. Klappa was Executive Vice President, Chief Financial Officer and Treasurer of Southern Company (NYSE: SO) in Atlanta, Georgia and also held the positions of Chief Strategic Officer, North American Group President of Southern Energy Inc., Senior Vice President of Marketing for Georgia Power Company, a subsidiary of Southern Company and President and Chief Executive Officer of South Western Electricity, Southern Company'sCompany’s electric distribution utility in the United Kingdom. Mr. Klappa also serves as a director of Badger Meter Inc. (NYSE: BMI) and is co-chair of the Milwaukee 7, a regional economic development initiative. He previously served as director of Joy Global Inc. (NYSE: JOY) from 2006 until April 2017 when Joy Global Inc. was acquired by Komatsu Mining Corp. He is also an officer and member of the Vice-ChairmanExecutive Committee of the Metropolitan Milwaukee Association of Commerce and serves on the School of Business Advisory Council for the University of Wisconsin-Milwaukee.Klappa'sKlappa also served on the board of directors of Joy Global Inc. from 2006 until the company was acquired in 2017.

Mr. Klappa’s qualifications to serve as a director of Associated, and as a memberchair of the Audit Committee and Compensation and Benefits Committee, and member of the Corporate Governance and Social Responsibility Committee include his more than 40 years of management experience in large publicly traded companies, including over 25 years at a senior executive level, and his recognized leadership in the economic development of southeastern Wisconsin. Mr. Klappa also meets the requirements of an audit committee financial expert.Richard T. Lommen

Director since 2004Age: 73Mr. Lommen is Chairman of the Board of Courtesy Corporation, a McDonald's franchisee, located in La Crosse, Wisconsin. Prior to that, he served as President of Courtesy Corporation from 1968 to 2006. Mr. Lommen served as Vice Chairman of the Board of First Federal Capital Corp from April 2002 to October 2004, when it was acquired by Associated.Mr. Lommen's qualifications to serve as a director of Associated, Chairman of the Compensation and Benefits Committee and a member of the Trust Committee include his successful small business/franchise ownership, his experience in all aspects of franchise ownership, particularly management and instruction of retail employees, and marketing and sales to consumers and his service as Vice Chairman of First Federal Capital Corp.Cory L. Nettles

Cory L. Nettles

4853Baird'sBaird’s Baird Funds, Inc., mutual fund complex, and several nonprofit organizations including the Medical College of Wisconsin, the Greater Milwaukee Foundation and the University of Wisconsin Foundation and Lawrence University. He previously served on the board of The Private Bank-Wisconsin.Nettles'Nettles’ qualifications to serve as a director of Associated, chair of the Enterprise Risk Committee and member of the Corporate Governance and Social Responsibility Committee and Corporate Development Committee and Enterprise Risk Committee include his strong business background and legal experience.Karen T. van Lith

5863Ms. van Lith is currently a contractorfounder and CEO of APEL Worldwide, LLC, an eCommerce investor. Prior to 2019, Ms. van Lith provided leadership for technology companies requiring transformative leadership as they go through start-up, rapid growth, mergers and acquisitions or business model changes. From June 2011 until June 2012, shechange. She served as Chief Executive Officer and a director of MakeMusic, Inc., a company that develops and markets music educationpublicly held technology solutions company and was publicly traded until April 2013. Ms. van Lith also serves as a director of E.A. Sween, a privately-held company doing business as Deli Express, since August 2012. Until June 2011, she ran an internet-marketing services company through Beckwith Crowe, LLC. Ms. van Lith was President and Chief Executive Officer of Gelco Information Network, a privately held provider of transaction and information processing systems to corporations and government agencies, based in Eden Prairie, Minnesota, until its sale to Concur Technologies in October 2007. She held various other positions of increasing authority with Gelco since 1999.systems. Ms. van Lith servedLith’s board experience includes serving as a director of publicly-tradedE.A. Sween, a privately held company doing business as Deli Express, from August 2012 to December 2019, a director of XRS Corporation, a publicly traded provider of fleet operations solutions to the transportation industry from 2010 until its sale to 2014.

Ms. van Lith'sLith’s qualifications to serve as a director of Associated, Chair of the Trust Committee and a member of the Compensation and Benefits Committee include her education in finance and accounting along with her past and present directorship experience in both public and private companies. Ms. van Lith provides the board with a strong understanding of accounting as well asand experience in small business start-ups.financial roles of large publicly held companies. She was a CPA, has practiced with an international public accounting firm and has served in various executive capacities. Although Ms. van Lith is not currently serving on Associated's Audit Committee, sheShe also meets the requirements of an audit committee financial expert.John (Jay) B. Williams

6671Mr. Williams is Chairman of the Board. He joined the Board of Directors in July 2011 following a 37-year career in banking. He is also past President and Chief Executive Officer of the Milwaukee Public Museum, Inc. Mr. Williams'Williams’ banking career included experience with retail, commercial, private client, operations and technology along with mergers and acquisitions. He is the Chairman of the Board of Church Mutual Insurance Company, which insures over 100,000 religious institutions, on the board of the Medical College of Wisconsin and on the Boardboard of Directorsdirectors of Northwestern Mutual Wealth Management, a subsidiary of Northwestern Mutual,Mutual.

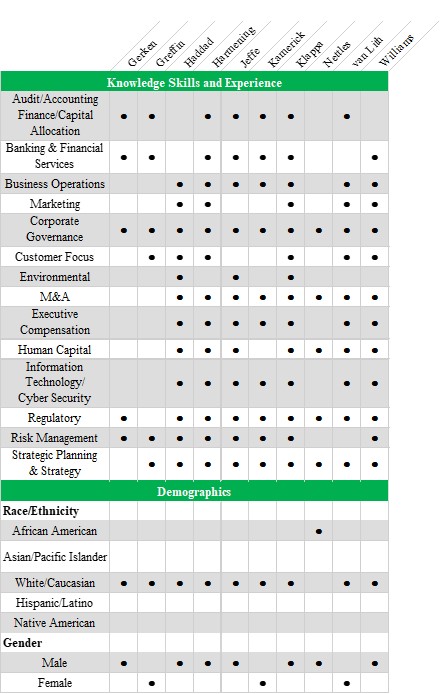

Mr. Williams is a member of the Medical College of Wisconsin, St. Norbert College, and the Milwaukee Public Museum.Williams'Williams’ qualifications to serve as a directorChairman of Associated and Chair of the Enterprise Risk Committee and member of the Audit Committee include his vast experience in the banking industry, as well as having earned NACD Director Certification, his certificationstatus as a NACD Board Leadership Fellow. In addition, Mr. Williams hasFellow and having earned the CERTa NACD Certificate in Cybersecurity Oversight.DIRECTOR QUALIFICATIONS Associated'sAssociated’s business consistent with their fiduciary duty to shareholders. This significant responsibility requires highly skilled individuals with variousa variety of qualities, attributes and professional experience. The Board believes that there are certain general requirements for service on Associated'sAssociated’s Board of Directors that are applicable to all directors, and that there are other skills and experience that should be represented on the Board as a whole but not necessarily by every director. The Board and the Corporate Governance and Social Responsibility Committee consider the qualifications of directors and director candidates individually and in the broader context of the Board'sBoard’s overall composition and Associated'sAssociated’s current and future needs.nominee'snominee’s judgment, integrity, experience, independence, understanding of Associated'sAssociated’s business or other related industries and such other factors that the Corporate Governance and Social Responsibility Committee determines are pertinent in light of the current needs of the Board. The Corporate Governance and Social Responsibility Committee also takes into account the ability of a director to devote themultiple culturesdiversity and a commitment to sustainability and to dealing responsibly with social issues. In addition to the qualifications required of all directors, the Board conducts interviews of potential director candidates to assess intangible qualities including the individual'sindividual’s ability to ask difficult questions and, simultaneously, to work collegially.Associated'sAssociated’s management.BOARD DIVERSITY DIRECTOR SKILLS AND EXPERIENCE MATRIX

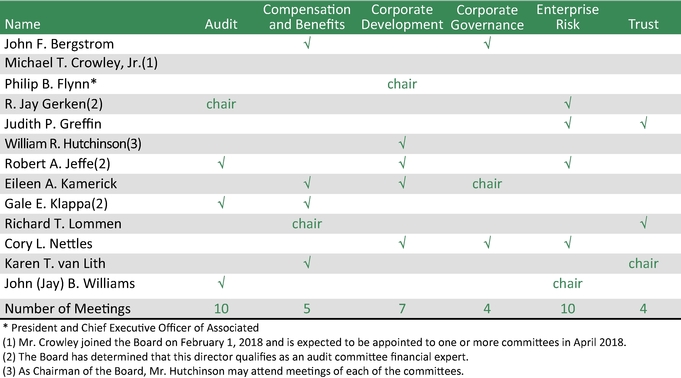

RECOMMENDATION OF THE BOARD OF DIRECTORS "FOR"“FOR” the election of Mses. Greffin, Kamerick and van Lith and Messrs. Flynn, Bergstrom, Crowley, Gerken, Hutchinson,Haddad, Harmening, Jeffe, Klappa, Lommen, Nettles and Williams to the Board of Directors.AFFIRMATIVE DETERMINATIONS REGARDING DIRECTOR INDEPENDENCE Associated's2017,2022, under the corporate governance rules of the NYSE. The Board has determined that all such directors are independent or were independent at the time they served as directors, under the NYSE corporate governance rules, except for Mr. Flynn,Harmening, President and CEOChief Executive Officer (“CEO”) of Associated.Mr. FlynnHarmening is not independent because of his servicehe serves as an executive officer of Associated, and not because of any other transactions or relationships.BOARD COMMITTEES AND MEETING ATTENDANCE sevenfive meetings during 2017.2022. During 2017,2022, each director who was a director for all of 20172022 attended at least 75% of the Board meetings held, and each such director attended at least 75% of the meetings of each committee of which he or she was a member.2017.2022. Executive sessions of Associated'sAssociated’s non-management directors are presided over by the Chairman of the Board.Associated'sAssociated’s operating subsidiaries, Associated Bank, National Association and Associated Trust Company, National Association. The Board believes that a single governing body to advise and determine strategy for the organization provides the Board with a comprehensive picture of the level and trends in operational and compliance risk exposure for the entire organization and ensures comprehensive oversight of regulatory matters.Associated'sAssociated’s website atat "Investor“Investor Relations," "Governance” “Governance Documents." We” Associated will describe on ourits website any amendments to or waivers from our Code of Business Conduct and Ethics in accordance with all applicable laws and regulations.Associated'sAssociated’s policy that all directors and nominees for election as directors at the Annual Meeting attend the Annual Meeting, except under extraordinary circumstances. All directors and nominees for director at the time of the 20172022 Annual Meeting of Shareholders attended the meeting.Associated'sAssociated’s website at www.associatedbank.com, "Investor“Investor Relations," "Governance” “Governance Documents."” The following summarizes the responsibilities of the various committees.March 1, 2018February 15, 2023 and the number of meetings held by each committee during 2017.2022.Name Audit Compensation

and BenefitsCorporate

DevelopmentCorporate

Governance and Social ResponsibilityEnterprise

RiskTrust √ √ Judith P. Greffin √ √ √ √ Andrew J. Harmening* chair chair √ √ √ √ chair chair √ Cory L. Nettles √ √ chair √ chair √ Number of Meetings 11 6 0 5 10 4

of the Board reviews the adequacy of internal accounting controls, reviews with Associated'sAssociated’s independent registered public accounting firm its audit plan and the results of the audit engagement, reviews the scope and results of procedures for internal auditing, reviews and approves the general nature of audit services by the independent registered public accounting firm, and reviews quarterly and annual financial statements issued by Associated. The Audit Committee has the sole authority to appoint or replace the independent registered public accounting firm, subject to ratification by the shareholders at the Annual Meeting. Both the internal auditors and the independent registered accounting firm meet periodically with the Audit Committee and have access to the Audit Committee at any time. In addition, the Audit Committee oversees management'smanagement’s bank regulatory compliance. of the Board include, among other duties directed by the Board, administration and oversight of Associated'sAssociated’s executive compensation, employee benefit programs and director compensation. The Compensation and Benefits Committee sets the strategic direction of Associated'sAssociated’s executive compensation policies and programs, and oversees managements'management’s execution of and compliance with that strategic direction. The Compensation and Benefits Committee determines the compensation of Associated's Chief Executive Officer (the "CEO")Associated’s CEO and, with input from the CEO, establishes the compensation of Associated'sAssociated’s other NEOs. The Compensation and Benefits Committee also has responsibility for ensuring that Associated'sAssociated’s incentive compensation programs do not encourage unnecessary and excessive risk taking that would threaten the value of Associated or the integrity of its financial reporting. As permitted under its charter, the Compensation and Benefits Committee engages an independent compensation consultant to advise it onAssociated'sAssociated’s executive officers and Board of Directors, which is described in detail under "Executive“Executive Compensation –- Compensation Discussion and Analysis,"” beginning on page 21. of the Board include, among other duties directed by the Board, reviewing and recommending to the Board proposals for acquisition or expansion activities. of the Board include corporate governance oversight, review and recommendation for Board approval of Board and committee charters. The Corporate Governance and Social Responsibility Committee also reviews the structure and composition of the Board, considers qualification requirements for continued Board service, and recruits new director candidates. The Corporate Governance and Social Responsibility Committee also advises the Board with respect to the Code of Business Conduct and Ethics. of the Board include oversight of the enterprise-wide risk management framework of Associated, including the strategies, policies and practices established by management to identify, assess, measure and manage significant risks. of the Board include the supervision of the trust and fiduciary activities of Associated Bank, National Association and Associated Trust Company, National Association to ensure the proper exercise of their trust/fiduciary powers.SEPARATION OF BOARD CHAIRMAN AND CEO Associated's and by-laws require the separation of the positions of Chairman of the Board and CEO. Currently, Mr. HutchinsonWilliams serves as Chairman of the Board and Mr. FlynnHarmening serves as CEO. These positions have been separated since Mr. Flynn joined Associated in December 2009, at which time the Board determined that Mr. Hutchinson, Associated's former Lead Director, serving as Chairman would enhance the effectiveness of the Board. The Board also recognizedthat managing the Board in an increasingly complex economic and regulatory environment is a particularly time-intensive responsibility. Separating the roles allows Mr. FlynnHarmening to focusBOARD DIVERSITYDIRECTOR NOMINEE RECOMMENDATIONS Committee considers attributes of diversity as outlined in the Corporate Governance Committee Charter when considering director nominees. While these attributes are considered on an ongoing basis, they are particularly considered in the recruitment and deliberation regarding prospective director nominees. The Corporate Governance Committee Charter outlines desired diversity characteristics for Board member experience and competencies. The Corporate Governance Committee believes that Associated's best interests are served by maintaining a diverse and active Board membership with members who are willing, able and well-situated to provide insight into current business conditions, opportunities and risks. The "outside" perspectives of the Board members are key factors in contributing to our success. The following diversity principles have been adopted:•The number of directors should be maintained at 10 to 14 persons with the flexibility to expand, if required, to support acquisitions or mergers.•Geographic diversity, as it relates to the markets Associated serves.•Industry representation, including a mix and balance of manufacturing, service, public and private company experience.•Multi-disciplinary expertise, including financial/ accounting expertise, sales/marketing expertise, mergers and acquisition expertise, regulatory, manufacturing, and production expertise, educational institutions, and public service expertise.•Experience with technology, including cyber security, digital marketing and social media.•Racial, ethnic, and gender diversity.•A majority of the members of the Board will be "independent" directors as defined by applicable law, including the rules and regulations of the SEC and the rules of the NYSE.The Corporate Governance Committee periodically assesses the effectiveness of these diversity principles. In light of the current Board's representation of diverse industry, background, communities within Associated's markets, professional expertise and racial and gender diversity, the Corporate Governance Committee believes that Associated has effectively implemented these principles.DIRECTOR NOMINEE RECOMMENDATIONSThe Corporate GovernanceSocial Responsibility Committee will consider any nominee recommended by a shareholder as described in this section under the same criteria as any other potential nominee. The Corporate Governance and Social Responsibility Committee believes that a nominee recommended for a position on the Board must have an appropriate mix of experience, diverse perspectives, and skills. Qualifications for nomination as a director can be found in the Corporate Governance and Social Responsibility Committee Charter. At a minimum, the core competencies should include accounting or finance experience, market familiarity, business or management experience, industry knowledge, customer-base experience or perspective, crisis response, leadership, and/or strategic planning.Act)Act of 1934, as amended (the “Exchange Act”)) and any other ownership interest in the shares of Associated, whether economic or otherwise, including derivatives and hedges, by each proposed nominee; (3) any other information regarding such proposed nominee that would be required to be disclosed in a definitive proxy statement prepared in connection with an election of directors pursuant to Section 14(a) of the Exchange Act; and (4) the name and address (business and residential) of the shareholder making the recommendation; and (5) the number of shares of Associated beneficially owned (as defined by Section 13(d) of the Exchange Act) and any other ownership interest in the shares of Associated, whether economic or otherwise, including derivatives and hedges, by the shareholder making the recommendation. Associated may require any proposed nominee to furnish additional information as may be reasonably required to determine his or her qualifications to serve as a director of Associated.COMMUNICATIONS BETWEEN SHAREHOLDERS, INTERESTED PARTIES AND THE BOARD Associated'sAssociated'sAssociated’s Corporate Secretary and submitted to the Board or the individual director, asAssociated'sAssociated’s business, or communications that relate to improper or irrelevant topics.COMPENSATION AND BENEFITS COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION SECURITY OWNERSHIP OF BENEFICIAL OWNERS the Record Date. February 15, 2023.holdings as of December 31, 2017.holdings.

Beneficial Ownership(1)

Class(2)The Vanguard Group, Inc.100 Vanguard BoulevardMalvern, PA 1935513,027,522(3)7.65%12,798,892(4)7.52%13.38%10.31% 10,762,233(5)6.32%7.19%9,545,630(6)5.61%5.95% 5.25%"beneficially owned"“beneficially owned” by a person if such person, directly or indirectly, has or shares (a) the power to vote or to direct the voting of such shares, or (b) the power to dispose or direct the disposition of such shares. In addition, a person is deemed to beneficially own any shares of which such person has the right to acquire beneficial ownership within 60 days.170,199,951150,865,438 shares of common stock outstanding as of February 27, 2018.February 12, 2018, The Vanguard Group, Inc. ("Vanguard") has sole voting power with respect to 80,047 shares, shared voting power with respect to 16,526 shares, sole dispositive power with respect to 12,942,657 shares and shared dispositive power with respect to 84,865 shares. Vanguard Fiduciary Trust Company and Vanguard Investments Australia, Ltd., each a wholly owned subsidiary of Vanguard, are beneficial owners of 68,339 shares and 28,234 shares, respectively, as a result of serving as investment managers to their respective clients.(4)Based on an amended Schedule 13G filed on February 8, 2018,January 26, 2023, BlackRock, Inc. and certain affiliated entities have sole voting power with respect to 12,226,47119,595,643 shares and sole dispositive power with respect to 20,180,320 shares.12,786,59215,274,649 shares and shared dispositive power with respect to 12,300276,924 shares.aan amended Schedule 13G filed on February 9, 2018,14, 2023, Dimensional Fund Advisors LP ("DFA"(“DFA”) has sole voting power with respect to 10,527,56310,652,019 shares and sole dispositive power with respect to 10,762,23310,842,604 shares. DFA is a registered investment adviser to four mutual fundsinvestment companies and serves as investment manager or sub-adviser to various other clients (collectively, the "Funds"“Funds”). In these roles, DFA or its subsidiaries (collectively, "Dimensional"“Dimensional”) may possess voting and/or investment power over the securities of the issuer that are owned by the Funds, and may be deemed to be the beneficial owner of such shares. Dimensional disclaims beneficial ownership of such securities.an amendeda Schedule 13G filed on February 13, 2018,9, 2023, FMR LLC and certain affiliated entities and individualssubsidiaries have sole voting power with respect to 54,0708,975,029 shares and sole dispositive power with respect to 9,545,6308,982,818 shares.

(7) Based on a Schedule 13G filed on February 1, 2023, State Street Corporation and certain subsidiaries have shared voting power with respect to 7,529,527 shares and shared dispositive power with respect to 7,919,166 shares.STOCK OWNERSHIP GUIDELINES FOR EXECUTIVE OFFICERS AND DIRECTORS Associated'sAssociated'sAssociated’s executive officers and directors are fully aligned with long-term shareholder value.Associated'sCommitteeLeadership Team (which is composed of colleagues that directly report to the Chief Executive Officer) and other key executives identified by the CEO, include: andofficer'sofficer’s annual base salary –- six times for Mr. Flynn andthe CEO, three times for each of the named executive officers, two times for all other executive officersleadership team members, and one times for the EVP, Chief Audit Executive, subject to the guidelines. For purposes of the guidelines, shares held by an executive officer include shares held directly, held in an executive officer'sthe Executives’ and Directors’ Deferred Compensation Plans, granted through annual equity awards, held in the 401(k) plan, shares represented by time-based RSUs, and shares purchased throughoutright. Shares subject to stock options and preferred shares are excluded; andEmployee Stock Purchase Plan, unvested shares of restricted stock and 25% of unvested restricted stock units ("RSUs").date on which they first were appointed an executive.Associated'sAssociated’s director stock ownership guidelines require each independent member of the Board to own shares of Common Stock with a value equal to five times the value of the annual equity grant awardedcash retainer payable to the directors.a director. Directors are required to attain such stock ownership goal no later than five years from the date on which they first were appointed to the Board. Balances in the Directors'Directors’ Deferred Compensation Plan and RSUsrestricted stock units (“RSUs”) count toward satisfying this requirement.Associated'sAssociated’s Insider Trading Policy, directorsemployees, officers, and executive officersdirectors are prohibited from engaging in hedging transactions with respect to Associated Common Stock and from pledging Associated Common Stock as collateral for loans, with the exception, for directors only, of pledges already in place when the prohibition on pledging was adopted in 2012. All of the NEOs are in compliance with this policy. Where applicable, shares pledged as collateral will not be counted for purposes of compliance with the stock ownership guidelines.SECURITY OWNERSHIP OF DIRECTORS AND MANAGEMENT the Record DateFebruary 15, 2023 concerning beneficial ownership of Common Stock, depositary shares and RSUs by each director, and each NEO, and by directors and executive officers as a group. TheCOMMON STOCKName of Beneficial Owner Amount and Nature of

Beneficial Ownership(1)Shares Issuable

Within 60 Days(2)Percent

of ClassDirectors Philip B. Flynn 1,258,486 633,649 * John F. Bergstrom 20,500 — * Michael T. Crowley, Jr. 884,931 — * R. Jay Gerken 2,000 — * Judith P. Greffin — — * William R. Hutchinson 67,333 — * Robert A. Jeffe — — * Eileen A. Kamerick — — * Gale E. Klappa — — * Richard T. Lommen 67,828 — * Cory L. Nettles — — * Karen T. van Lith 10,000 — * John (Jay) B. Williams 6,000 — * Named Executive Officers Christopher J. Del Moral-Niles 215,721 139,648 * Randall J. Erickson 167,961 87,714 * John A. Utz 155,448 107,445 * David Stein 220,501 134,913 * All Directors and Executive Officers as a group (27 persons) 3,619,348(3) 1,420,592 2.13% *Denotes percentage is less than 1%.(1)Beneficial ownership includes shares with voting and investment power in those persons whose names are listed above or by their spouses or trusts. Some shares may be owned in joint tenancy, by a spouse, by a corporate entity, or in the name of a trust or by minor children. Shares include shares issuable within 60 days of the Record Date and vested and unvested service-based restricted stock.(2)Shares subject to options exercisable within 60 days of the Record Date.(3)Includes an aggregate of 15,032 shares that have been pledged by a director in securities brokerage accounts in compliance with Associated's Insider Trading Policy.RESTRICTED STOCK UNITSBeneficial OwnerNumber of RSUsDirectorsJohn F. Bergstrom31,958Michael T. Crowley, Jr.4,669R. Jay Gerken26,072Judith P. Greffin9,524William R. Hutchinson35,912Robert A. Jeffe31,958Eileen A. Kamerick31,958Gale E. Klappa15,480Richard T. Lommen31,958Cory L. Nettles30,987Karen T. van Lith31,958John (Jay) B. Williams31,958All Directors as a group314,392 COMMON STOCKName of Beneficial Owner Percent

of ClassDirectors Andrew J. Harmening 282,544 — * R. Jay Gerken 2,000 — * Judith P. Greffin — — — Michael J. Haddad 3,662 — * Robert A. Jeffe — — — Eileen A. Kamerick 4,957 — * Gale E. Klappa — — — Cory L. Nettles — — — Karen T. van Lith 15,008 — * John (Jay) B. Williams 21,907 — * Named Executive Officers Derek S. Meyer 43,685 — * 84,324 — * John A. Utz 329,059 225,929 * Randall J. Erickson 369,430 230,458 * David L. Stein 313,097 182,792 * All Directors and Executive Officers as a group (24

persons)2,251,652 1,163,957 1.49% Beneficial OwnerNumber of RSUsNamed Executive OfficersPhilip B. Flynn191,671Christopher J. Del Moral-Niles45,308Randall J. Erickson42,320John A. Utz39,101David Stein30,283All Executive Officers as a group (15 persons)525,880 Each RSU represents the contingent right to receive one share of Common Stock. For the non-employee directors, the RSUs vest 100% on the fourth anniversary of the grant date. For executive officers, RSUs are subject to performance-based and/or time-based vesting criteria as set forth in the applicable RSU award agreement.DEPOSITARY SHARES OF PREFERRED STOCKThe following table provides information concerning beneficial ownership of depositary shares. Each depositary share represents a 1/40th ownership interest in a share of Associated's 6.125% Non-Cumulative Perpetual Preferred Stock, Series C (the "Series C Preferred Stock") or Associated's 5.375% Non-Cumulative Perpetual Preferred Stock, Series D (the "Series D Preferred Stock"), as indicatedin the table. Each of the Series C Preferred Stock and the Series D Preferred Stock has a liquidation preference of $1,000 per share (equivalent to $25 per depositary share). Holders of depositary shares are entitled to all proportional rights and preferences of the Series C Preferred Stock or Series D Preferred Stock, as applicable (including dividend, voting, redemption and liquidation rights). Amount and Nature of Beneficial

Ownership(1) Percent of Class Series C

Preferred StockSeries D

Preferred StockSeries C

Preferred StockSeries D

Preferred StockDirectors Philip B. Flynn 40,000 — 1.54% * John F. Bergstrom — 40,000 * 1.00% Michael T. Crowley, Jr. — — * * R. Jay Gerken 4,000 — * * Judith P. Greffin — — * * William R. Hutchinson — — * * Robert A. Jeffe — 60,000 * 1.5% Eileen A. Kamerick — — * * Gale E. Klappa — 4,000 * * Richard T. Lommen — — * * Cory L. Nettles — — * * Karen T. van Lith — — * * John (Jay) B. Williams — — * * Named Executive Officers Christopher J. Del Moral-Niles — — * * Randall J. Erickson — — * * John A. Utz — — * * David Stein 1,000 2,000 * * All Directors and Executive Officers as a group (27 persons) 45,000 106,000 1.73% 2.65% Table(2) Shares subject to options exercisable within 60 days of ContentsRESTRICTED STOCK UNITS Beneficial Owner Number of RSUs Directors Andrew J. Harmening 458,091 R. Jay Gerken 36,638 Judith P. Greffin 16,867 Michael J. Haddad 5,499 Robert A. Jeffe 43,669 Eileen A. Kamerick 43,669 Gale E. Klappa 23,983 Cory L. Nettles 42,505 Karen T. van Lith 43,669 John (Jay) B. Williams 43,669 All Non-Employee Directors as a group 300,168 Beneficial Owner Number of RSUs Named Executive Officers Derek S. Meyer 87,126 — John A. Utz 72,119 Randall J. Erickson 63,601 David L. Stein 65,088 All Executive Officers as a group (15 persons) 1,082,620 DEPOSITARY SHARES OF PREFERRED STOCK Name of Beneficial Owner Percent of Class Series E Preferred Stock Series F Preferred Stock Series E Preferred Stock Series F Preferred Stock Directors Andrew J. Harmening — — — — R. Jay Gerken — 2,000 — * Judith P. Greffin — — — — Michael J. Haddad — 2,000 — * Robert A. Jeffe — — — — Eileen A. Kamerick — — — — Gale E. Klappa 2,000 2,000 * * Cory L. Nettles — — — — Karen T. van Lith — — — — John (Jay) B. Williams — — — — Named Executive Officers Derek S. Meyer — — — — — — — — John A. Utz — — — — Randall J. Erickson — — — — David L. Stein 4,000 — * — 6,000 6,000 * * OWNERSHIP IN DIRECTORS'DIRECTORS’ DEFERRED COMPENSATION PLANDirectors'Directors’ Deferred Compensation Plan with the balances in phantom stock as of the Record DateFebruary 15, 2023 set forth below. The dollar balances in these accounts are expressed daily in units of Common"Director“Director Compensation – Directors'- Directors’ Deferred Compensation Plan"Plan” on page 44.52. Account Balance at

the Record DateEquivalent Number

of Shares of

Common Stock(1)Beneficial Owner $ 173,471 6,925 — — — — R. Jay Gerken $615,164 25,441 — — Judith P. Greffin 615,164 25,441 559,492 22,335 Michael J. Haddad Michael J. Haddad 801,011 33,127 449,698 17,952 Robert A. Jeffe 1,382,492 57,175 570,839 22,788 Eileen A. Kamerick 659,413 27,271 — — Gale E. Klappa 615,164 25,441 1,833,961 73,212 — — Cory L. Nettles 672,954 27,831 520,138 20,764 Karen T. van Lith 600,849 24,849 94,288 3,764 John (Jay) B. Williams 108,907 4,504 $ 4,201,887 167,740 All Directors as a group $6,071,118 251,080

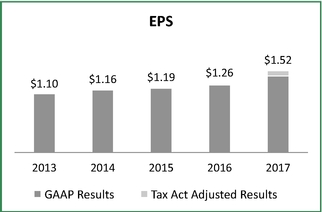

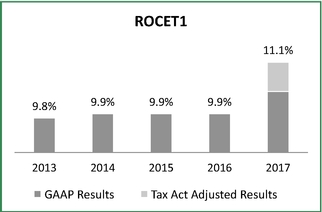

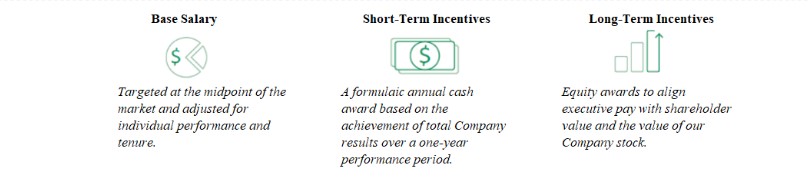

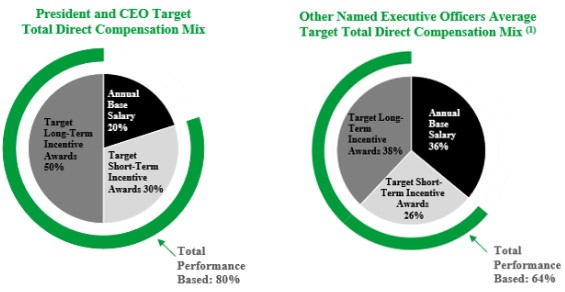

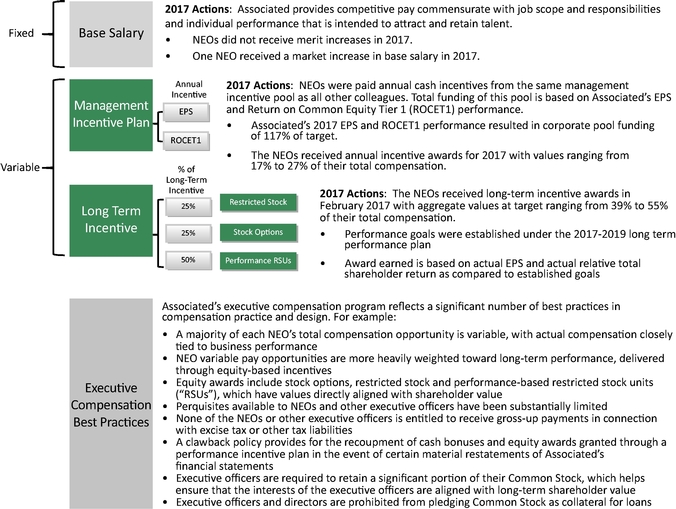

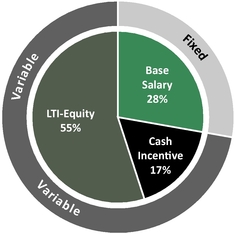

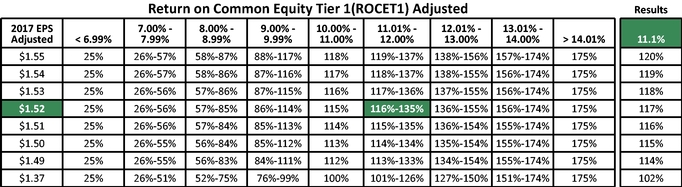

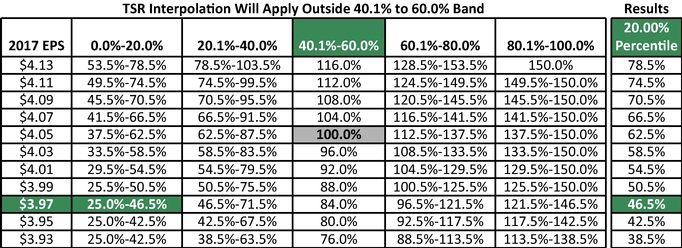

as of February 15, 2023.$25.05$24.18 of the Common Stock on the Record Date.BANC-CORP'SBANC-CORP’S NAMED EXECUTIVE OFFICER COMPENSATIONAssociated'splays a key rolefor our NEOs and our executive compensation philosophy, policies and practices as described in Associated's abilitythis Proxy Statement. The non-binding resolution approving our executive compensation program was approved by approximately 95% of the shareholders present or represented by proxy at our 2022 Annual Meeting of Shareholders.motivate the highest quality executive team.reward highly qualified and talented executives who will enable us to execute on our strategic priorities, perform better than our competitors and drive long-term shareholder value. The principal objectivesunderlying core principles of Associated'sour executive compensation program are to target executive compensation within competitive market ranges, reward performance, and(i) align executive incentive compensation with long-term shareholder value creation, (ii) provide target executive compensation within competitive market levels, and (iii) reward performance, without incentingincentivizing unnecessary or excessive risk. As discussed in the Compensation Discussion and Analysis, which begins on page 21, the Compensation and Benefits Committee (the "Committee") has designed the program to incorporate a number of features and best practices that support these objectives, including, among others:•Target total compensation for Associated's Named Executive Officers at market-competitive levels,risk, while maintaining an overall compensation program that is aligned with and reflects the performance of Associated;each of Associated's Named Executive Officer's targettotal executive compensation is variable;Variable pay opportunities are more heavily weighted towardperformance and delivered through equity-based incentives;•Equityincentive compensation awards are granted in the form of Associated shares of stock.options, RSUsunits (75% of awards) and performance-based RSUs, which are directly alignedtime-based restricted stock units (25% of awards) to align with shareholder value;Stock Ownership requirements,includeincludes both a salary multiple and post vesta post-vesting holding period.place for all Executive Committee members;•Noneour change of Associated's Named Executive Officers are entitled to receive gross-upcontrol severance compensation plan, or COC Plan.liabilities; andOnlyperquisites are available to Associated's Named Executive Officers.Shareholders are encouraged to carefully review the "Executive Compensation" section of this Proxy Statement in its entirety for a detailed discussion of Associated's executiveperquisites.program.Asconsultant.Named Executive OfficersNEOs as disclosed pursuant tounder Item 402 of Regulation S-K through the following resolution:"Associated'sAssociated’s Named Executive Officers as disclosed pursuant to the compensation rules of the SEC in the Compensation Discussion and Analysis, the compensation tables and any related materials."uponon the Board of Directors. However, the Compensation and Benefits Committee will take into accountconsider the outcome of the vote when consideringcontemplating future executive compensation arrangements.RECOMMENDATION OF THE BOARD OF DIRECTORS "FOR"“FOR” the advisory approval of Associated Banc-Corp's Named Executive OfficerBanc-Corp’s NEO compensation, as disclosed pursuant to the compensation disclosure rules of the SEC (which disclosure includes the Compensation Discussion and Analysis, the compensation tables, and any related material). If a majority of the votes cast isare voted "FOR"“FOR” this Proposal 2, it will pass. Unless otherwise directed, all proxies will be voted "FOR"“FOR” Proposal 2.EXECUTIVE COMPENSATIONCOMPENSATION DISCUSSION AND ANALYSISCD&A DIRECTORY21ECONOMIC AND SOCIAL IMPACT (1) Community service time in dollars is calculated by using the Independent Sector national volunteer hour rate as of April 2022. DIVERSITY, EQUITY & INCLUSION Approximately 45% of colleagues participate in Colleague Resource Groups 86% of colleagues feel Associated values diversity and inclusion LETTER TO SHAREHOLDERS CD&A DIRECTORY Associated'sOur executive compensation program is overseen bydesigned to be significantly performance-based and aligned with shareholder objectives. We maintain an executive compensation program that allows us to attract, retain, motivate and reward highly qualified and talented executives who will enable us to execute on our strategic priorities, out perform our competitors and drive long-term shareholder value."Committee"“Committee”) for fiscal year 2022. While the principles and intended to provide a balanced program that rewards corporate, business area, and individual results that support Associated's mission, with a focus on performance-based compensation. The program's strong pay-for-performance alignment is an important partobjectives of Associated's continuing commitment to enhancing long-term shareholder value. This summary highlights our 2017 financial performance, the elements of the executive compensation program extend to our entire Executive Leadership Team (“ELT”), this CD&A primarily covers the compensation provided to our Named Executive Officers (“NEOs”) identified in the table below.key changesnarrative discussion as they provide information and context to the program in 2017.2017compensation and disclosures.Named Executive Officer Title Andrew J. Harmening President and Chief Executive Officer (“CEO”) Executive Vice President, Chief Financial Officer Executive Vice President, Chief Financial Officer, Retired John A. Utz Executive Vice President, Head of Corporate Banking and Milwaukee Market President Randall J. Erickson Executive Vice President, General Counsel & Corporate Secretary David L. Stein Executive Vice President, Head of Consumer & Business Banking and Madison Market President Performance2017 was another strong year for Associated. Associated continues to maintain a healthy balance sheet with strong capitalOfficer.liquidity levels. Associated is committed to making investments to expand services, develop new products and services, and drives new business. As evidence of Associated's commitment to growth, Associated entered into a definitive agreement of merger with Bank Mutual Corporation in 2017, which closedretired as an employee on FebruarySeptember 1, 2018. With this acquisition, Associated will be able to expand its client base and generate new business.Reflecting another year of growth, Associated reported GAAP earnings per common share ("EPS") of $1.42 and Return on Common Equity Tier 1 ("ROCET1") of 10.4%. 2017 EPS included $15 million, or $0.10 per common share, of expenses related to the recently enacted Tax Cuts and Jobs Act of 2017 (the "Tax Act"). Adjusting for this one-time tax event, the Tax Act adjusted EPS was $1.52 and the Tax Act adjusted ROCET1 was 11.1%. See page 43 for a reconciliation of Tax Act adjusted EPS and ROCET1 to the GAAP equivalents.Consistent with Associated's focus on delivering increased value and returning capital to its shareholders, dividends per common share increased 11% in 2017 to $0.50. In addition, Associated repurchased 1.6 million of Common Stock, which did not have a material impact on EPS.Associated also continued to grow its balance sheet with average loans increasing 5% year-over-year to $20.6 billion. In addition, average deposits of $21.9 billion for 2017 increased 4% from 2016.These results reflect the continuing commitment of colleagues and executive officers throughout Associated to serving the needs of Associated's customers and enhancing long-term shareholder value.Common Equity Tier 1, a non-GAAP financial measure, is used by banking regulators, investors and analysts to assess and compare the quality and composition of Associated's capital with the capital of other financial services companies. Management uses Common Equity Tier 1 along with other capital measures, to assess and monitor Associated's capital position. The Federal Reserve establishes regulatory capital requirements, including well-capitalized standards for Associated. Prior to 2015, the regulatory capital requirements effective for the Corporation followed the Capital Accord of the Basel Committee on Banking Supervision. Beginning January 1, 2015, the regulatory capital requirements effective for Associated follow Basel III, subject to certain transaction provisions. Common Equity Tier 1 prior to Basel III requirements was calculated as Tier 1 capital excluding qualifying perpetual preferred stock and qualifying trust preferred securities. See Table 26 in Part II, Item 7 of the 2017 Form 10-K for a reconciliation of Common Equity Tier 1.

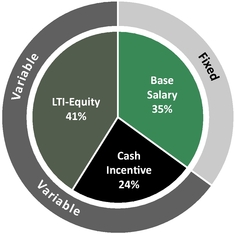

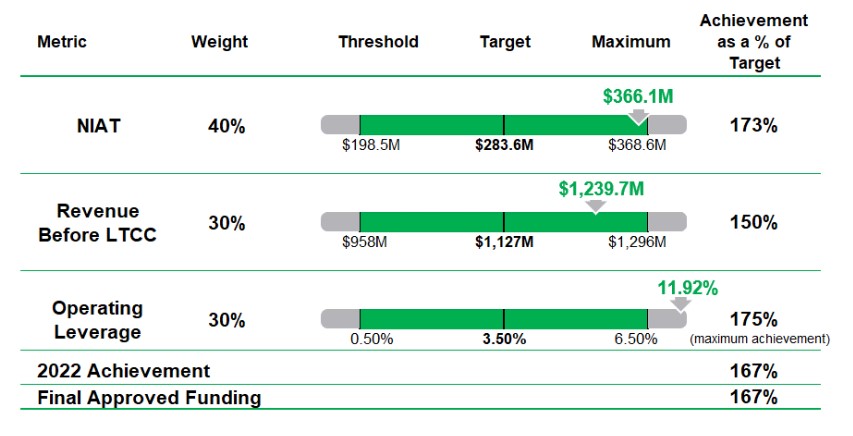

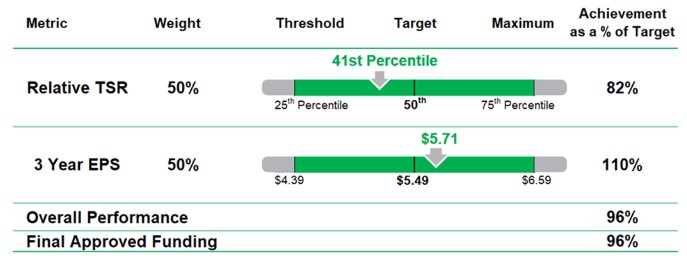

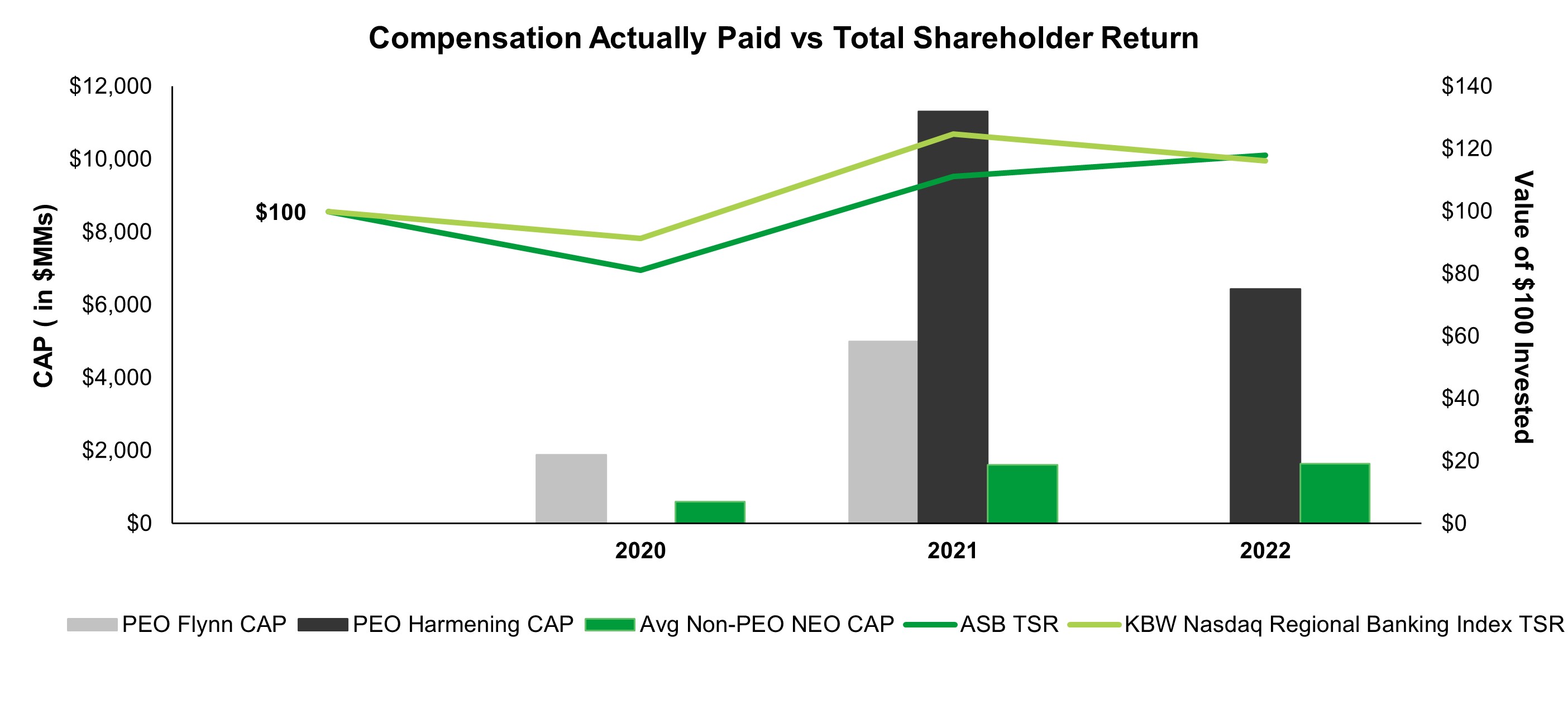

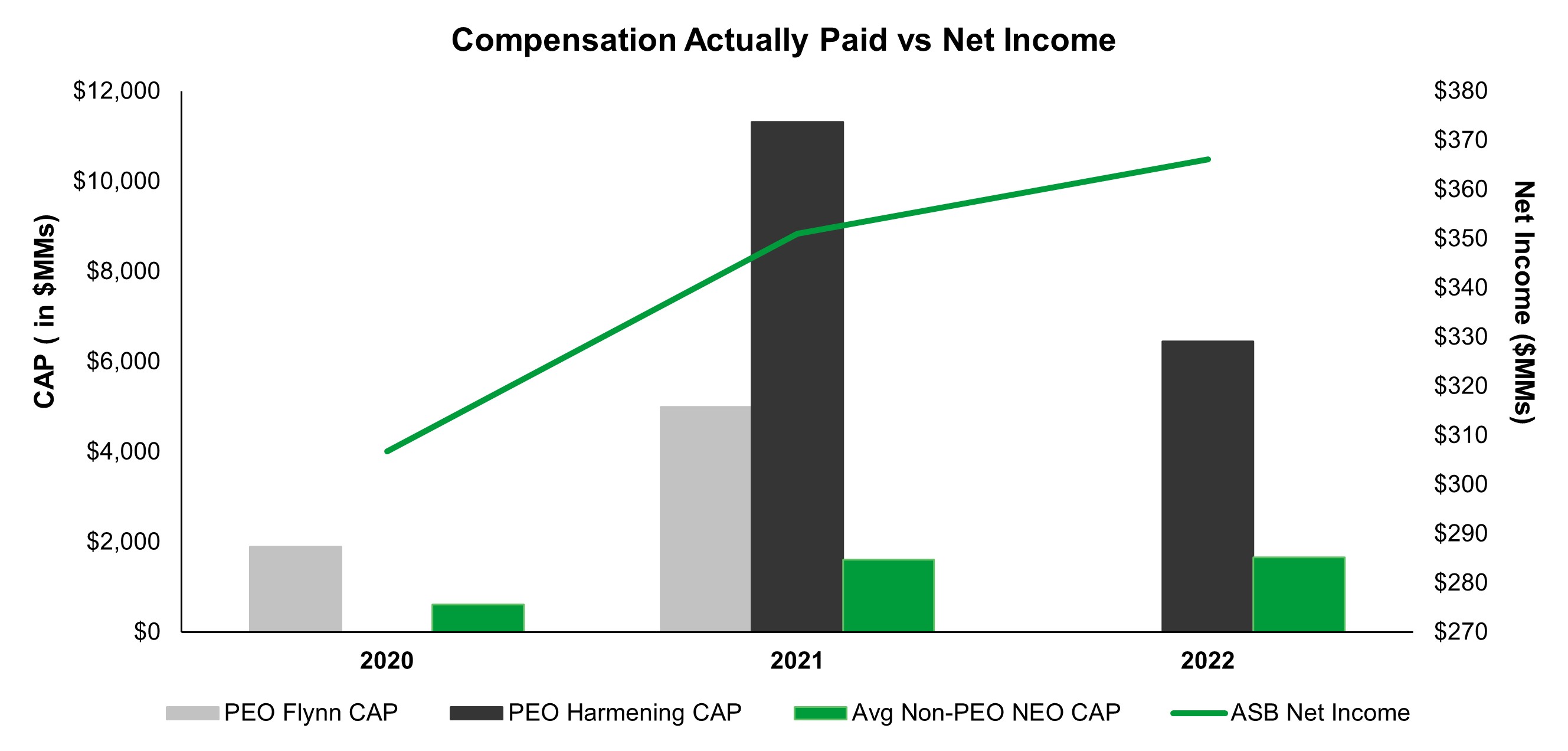

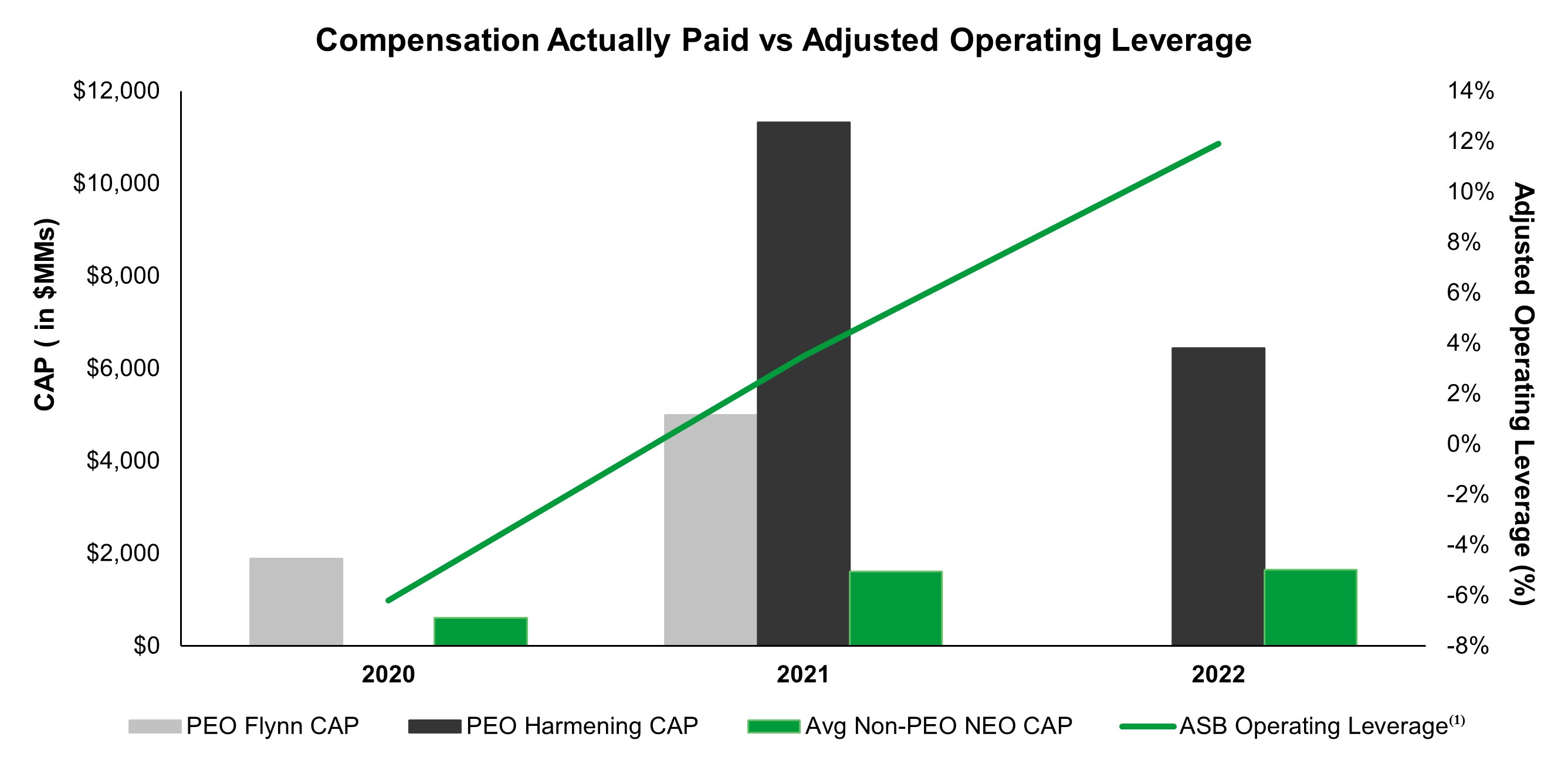

ELEMENTS OF ASSOCIATED'S EXECUTIVE COMPENSATION PROGRAM2022 Financial Highlights Net Income After Tax (NIAT) Revenue Before Long-Term Credit Charge Operating Leverage 12% Loans | Deposits Dividends Per Common Share $0.81

NEO 2022 Total Target Direct Compensation Andrew J. Harmening $ 1,000,000 $ 1,500,000 $ 2,500,000 $ 5,000,000 $ 490,000 $ 367,500 $ 539,000 $ 1,396,500 $ 505,000 $ 378,750 $ — $ 883,750 John A. Utz $ 490,000 $ 367,500 $ 539,000 $ 1,396,500 Randall J. Erickson $ 480,000 $ 336,000 $ 480,000 $ 1,296,000 David L. Stein $ 435,000 $ 326,250 $ 478,500 $ 1,239,750

What We Don’t Do:

X

X

X

X

X

X

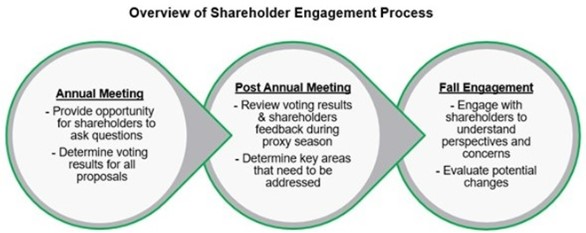

TableContentsShareholder Outreach and Responseour opportunities to 2017 Advisory Vote on NEO CompensationAssociated's 2017 advisory shareholderreceive feedback from shareholders regarding our executive compensation program. At our 2022 Annual Meeting of Shareholders, our shareholders had the opportunity to vote on NEO compensation once again indicated shareholder support for the program, with over 81%an advisory say-on-pay proposal and 95% of the votes cast were in favor of such proposal. Similarly, during our 2021 Annual Meeting of Shareholders, more than 94% of votes cast were in support of our executive compensation program. The Committee believes that such results have affirmed shareholder support of our revised approach to executive compensation. As a result, the Committee only made minor refinements to our executive compensation program in 2022. We remain committed to promoting ongoing dialogue via our shareholder outreach program so we can provide our shareholders with a forum to raise questions or voice any concerns.On an annual basis, the Company is in direct dialogue with between 50 and 100Each fall we reach out to our top institutional investors through regular attendance at industry conferences and invitation only investor events. This includes regular direct private one-on-one dialogues with mostwho hold a significant percentage of our outstanding shares. During the Company's top 20 shareholders. In addition, management engages with investors through conference calls tosession we discuss Company results, performance relative to industry trends, peer metrics, compensation plans, talent acquisition and development programs, environmental, social and governance matters,risks and initiatives, and the Company'sCompany’s strategic direction. During 2017, management engaged in additional specific outreachWe believe that by maintaining an open and transparent relationship with twoour shareholders with respectand listening to itstheir feedback and concerns represents best practices. The feedback we received from shareholders this year was positive, and no concerns were raised. Overall, the shareholders we met were approving of our current executive compensation practices to gainprogram. Below is a summary of our recent shareholder engagements and an understandingoverview of shareholder views on the Committee's decisionsour engagement process.Term Number of Investors Invited Percent Outstanding Shares Invitations Accepted Spring 2020 20 51% 6 Fall 2020 23 53% 11 Fall 2021 15 51% 3 Fall 2022 30 63% 2